In the world of life insurance, price (premium) is often the first and sometimes the only factor that consumers focus on when evaluating their options. It’s understandable: premiums are easy to compare, easy to place in a spreadsheet, and easy to rank from lowest to highest. But when it comes to protecting a family, a business, or an estate, the cheapest option may be far from the best option. In fact, relying on price alone can lead clients toward products that offer less value, fewer safeguards, and inadequate protection for the very risks they’re trying to solve.

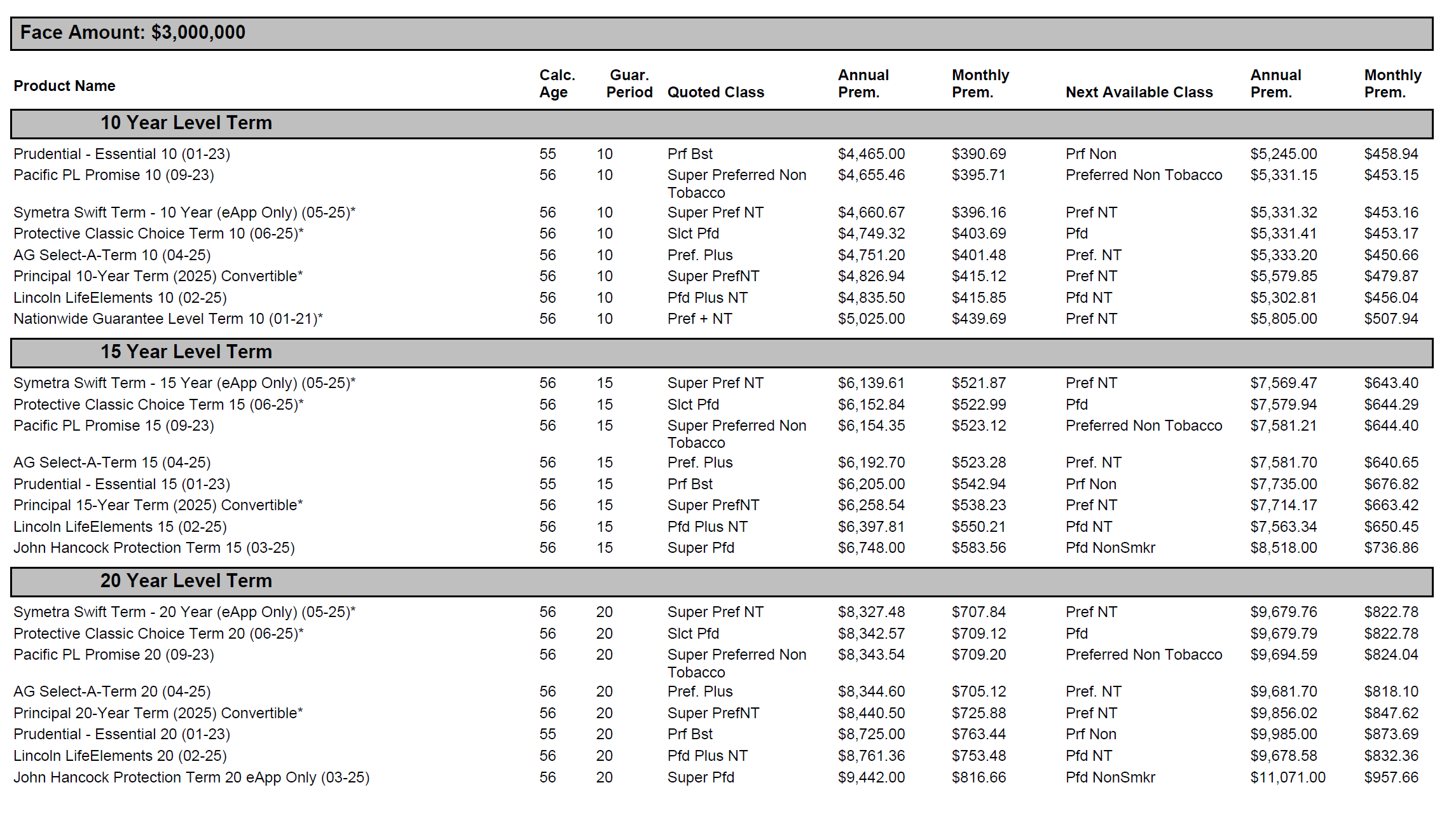

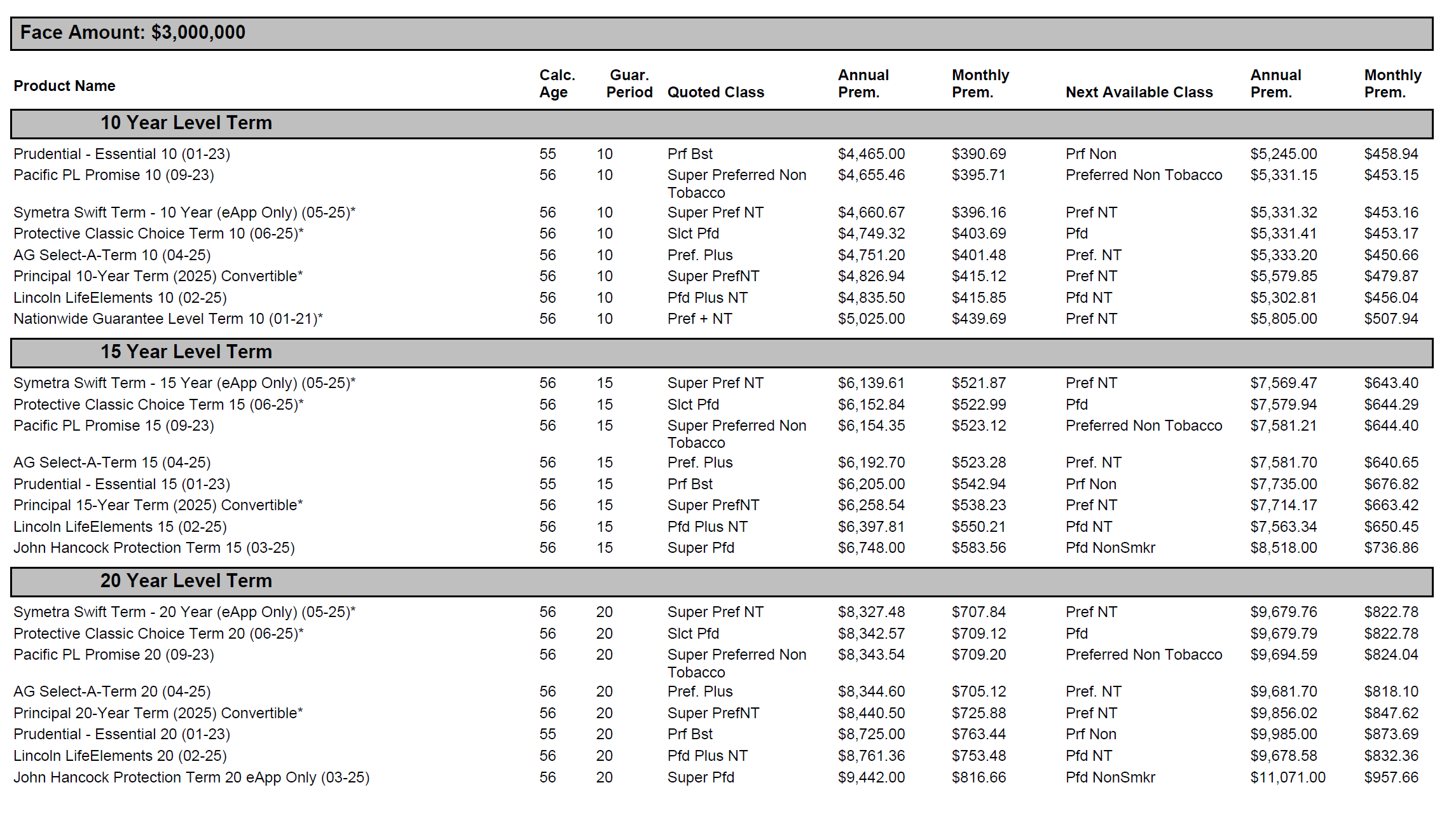

Most consumers don’t know what questions to ask about life insurance product differences, policy mechanics, or carrier strength. They’re rarely aware of the nuances: living benefits, conversion privileges, underwriting flexibility, policy guarantees, available riders, service standards, financial ratings, and contract language. These are some of the things that separate one life carrier from another. And far too often, many agents themselves simply hand over a spreadsheet without breaking down why one product costs a little more and what value that cost may represent. A spreadsheet shows numbers; it does not show value.

This creates a dangerous oversimplification: the belief that life insurance is a commodity. It isn’t. No two carriers offer identical contracts, and no two policies manage risk in the same way. For example, a slightly higher-priced product might include accelerated benefit riders for chronic or critical illness, more liberal conversion rights, better conversion products (usually an administrative decision by carriers, not a contract guarantee), better long-term guarantees, or lower policy charges that save money over time. Conversely, a lower cost policy might come with limited features, fewer consumer protections, or premium structures that are attractive in early years but far less competitive as the policy matures.

When consumers simply look at price, they tend to choose the lowest-priced product, believing they are being financially responsible. But financial responsibility isn’t just about minimizing cost - it’s about maximizing value. Your client doesn’t choose the least expensive doctor or dentist (as most people don’t), so why would they choose the least expensive life insurance product? The cheapest professional is rarely the one people trust with their health...or their wealth, and the cheapest life insurance product shouldn’t automatically be trusted as the best plan either.

Life insurance is a long-term contract with long-term consequences. A small difference in premium could reflect a major difference in contractual strength, underwriting philosophy, customer service, claims handling, or financial stability. These factors aren’t visible in a spreadsheet, but they can matter tremendously at claim time, during policy management, or when the client decides to convert, borrow, or exercise a benefit decades into the future.

This is why clients deserve a knowledgeable guide, like an agent or adviser who understands the “story behind the spreadsheet,” who can expose and communicate the distinction between price and value, and who can ensure that the client is selecting the right policy, not just the cheapest one. A well-informed comparison leads not only to better decisions, but also to greater peace of mind.

The bottom line: price matters, but not at the expense of protection. The goal is not to buy the cheapest life insurance. It’s to buy the right life insurance.