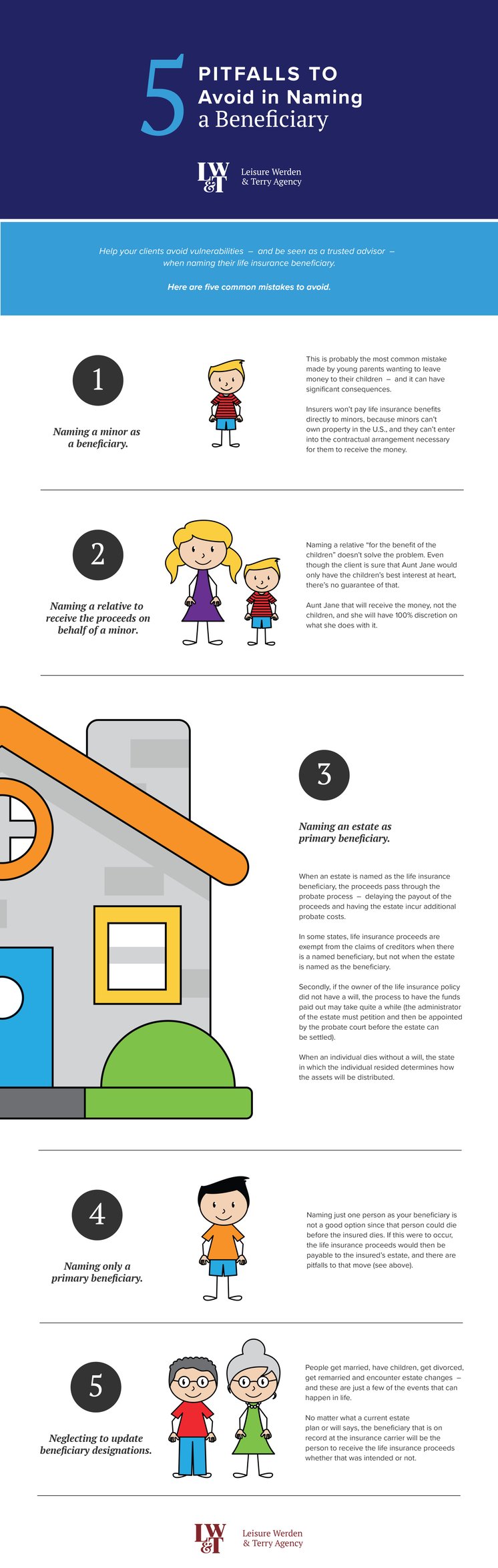

Help your client avoid vulnerabilities – and be seen as a trusted advisor – when naming their life insurance beneficiary.

The following infographic explains the five most common mistakes and how to bypass them.

1. Naming a Life Insurance Beneficiary Who Is a Minor.

This is probably the most common mistake made by young parents wanting to leave money to their children – and it can have significant consequences.

Insurers won’t pay life insurance benefits directly to minors, because minors can’t own property in the U.S., and they can’t enter into the contractual arrangement necessary for them to receive the money.

2. Naming a Relative to Receive the Proceeds on Behalf of a Minor.

Naming a relative “for the benefit of the children” doesn’t solve the problem. Even though the client is sure that Aunt Jane would only have the children’s best interest at heart, there’s no guarantee of that. Aunt Jane that will receive the money, not the children, and she will have 100% discretion on what she does with it.

3. Naming an Estate as Primary Beneficiary.

When an estate is named as the life insurance beneficiary, the proceeds pass through the probate process – delaying the payout of the proceeds and having the estate incur additional probate costs. In some states, life insurance proceeds are exempt from the claims of creditors when there is a named beneficiary, but not when the estate is named as the beneficiary.

Secondly, if the owner of the life insurance policy did not have a will, the process to have the funds paid out may take quite a while (the administrator of the estate must petition and then be appointed by the probate court before the estate can be settled). When an individual dies without a will, the state in which the individual resided determines how the assets will be distributed.

4. Naming only a primary beneficiary.

Naming just one person as your beneficiary is not a good option since that person could die before the insured dies. If this were to occur, the life insurance proceeds would then be payable to the insured’s estate, and there are pitfalls to that move (see above).

5. Neglecting to Update Beneficiary Designations.

People get married, have children, get divorced, get remarried and encounter estate changes – and these are just a few changes that can happen in life. No matter what a current estate plan or will says, the beneficiary that is on record at the insurance carrier will be the person to receive the life insurance proceeds whether that was intended or not.

Updated 8/2021