Editor’s note: This post was originally published on 3/9/16 and has been updated for accuracy and comprehension.

You’ve probably relied on them for years.

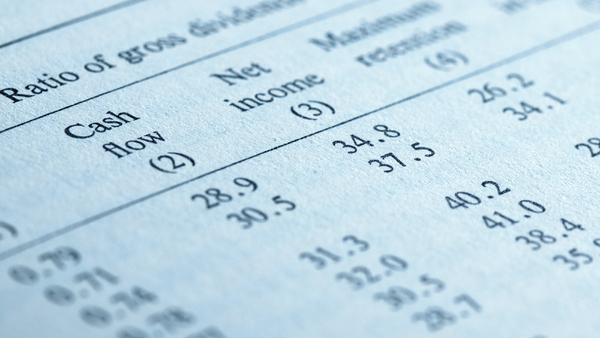

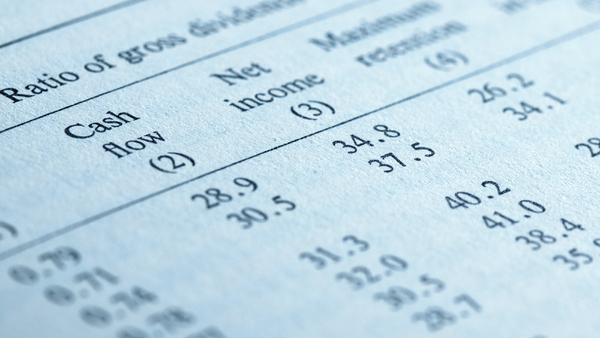

But life insurance comparison spreadsheets may not provide the level of information that you really need.

They have quite a few shortcomings. So why rely on them “as is?”

The simple truth is, life insurance spreadsheets don’t tell the whole story.

While you might want to keep spreadsheets as one of the tools in your arsenal to reach a decision, they shouldn’t be the only factor you consider.

Here are the two biggest reasons why.

1. The industry is changing

It’s pretty easy to see: Our insurance carrier partners are making lots of changes. Due to low interest rates and other factors, carriers are under immense pressure.

To stay competitive, they need to innovate and offer products that will truly appeal to your clients.

At the same time, they need to make a profit – and so do you.

As a result, life insurance carriers are performing a complicated balancing act.

What does this mean for you, the insurance agent or broker?

In reality, some of these changes are good, and some are not.

2. Price is no longer king

Price shouldn’t be the primary factor when choosing a life insurance carrier and product.

In reality, life insurance premium is just ONE factor that should dictate your choice of products.

That’s why life insurance comparison spreadsheets don’t tell the entire story.

They just tell one side of the story – maybe to the detriment of your clients, if that’s the only criteria you use to choose a product and carrier.

When you look at term or permanent insurance spreadsheets, you’re just seeing the cost in isolation.

And choosing a policy based solely on cost is not necessarily in your client’s best interest.

Meet the valuable players on your selection team

In addition to price, you should consider other factors when choosing a life insurance product, including:

- The product’s features.

- Conversion options (for term insurance).

- The carrier’s underwriting style.

- The carrier’s policy service standard.

- The company’s commitment to customer service.

How to choose a life insurance product

I’m not asking you to ditch life insurance spreadsheets altogether.

They can still play a role in the decision, but they just shouldn’t be the deciding factor.

The next time you’re looking at a term or permanent life insurance spreadsheet, pick up the phone and talk to a brokerage manager at your life insurance brokerage firm.

A good brokerage manager can help provide perspective on all of the important factors related to the life insurance product and carrier of choice.

When you make a decision about a life insurance product based solely on cost, you could be putting your client at risk. It’s not necessarily true that the cheapest policy will be the best one.

Get the whole picture

The life insurance industry is changing and price is no longer the most important factor when making the big decisions.

Life insurance comparison spreadsheets should inform your decision, along with other critical factors – not make the decision for you and your client.